san francisco payroll tax rate

2021 Social Security Payroll Tax Employee Portion Medicare Withholding 2021 Employee Portion California Individual Income Tax California State Disability Insurance Payroll Tax To. Form 941 Employers QUARTERLY Federal Tax Return Quarterly typically due at the end of April July.

1099 Tax Brackets For Independent Contractors

Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

. A 14 tax on the San Francisco payroll expense of a person or combined group engaging in business within San Francisco as an administrative office in lieu of other taxes provided in. Ad Find 10 Best Payroll Services Systems 2022. The Payroll Division also calculates payroll taxes and Social Security as well as ensuring that they are properly withheld and processed in compliance with City State and Federal wage.

Proposition F fully repeals the Payroll Expense Tax and increases the Gross. Discover ADP Payroll Benefits Insurance Time Talent HR More. Affordable Easy-to-Use Try Now.

Discover ADP Payroll Benefits Insurance Time Talent HR More. The Payroll Expense Tax will not be phased out in 2018 as originally. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021.

Ad Process Payroll Faster Easier With ADP Payroll. San Francisco imposes a Payroll Expense Tax on the compensation earned for work and services performed within the city. Effective January 1 2022 businesses subject to the San Francisco Administrative Office Tax AOT must pay an additional annual Overpaid Executive Tax OET of 04 to.

All Services Backed by Tax Guarantee. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the. Free Unbiased Reviews Top Picks.

Ad Compare This Years Top 5 Free Payroll Software. Determine non-taxable San Francisco payroll expenses. Proposition F fully repeals the Payroll Expense.

Get Started With ADP Payroll. For the Gross Receipts Tax GR we calculate 25 of your Gross Receipts Tax liability for 2021. Over the years the payroll tax rate has.

Get Started With ADP Payroll. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments. Proposition F eliminates the Citys Payroll Expense Tax and gradually raises. The 85 sales tax rate in San Francisco consists of 6 California state sales tax 025 San Francisco County sales tax and 225 Special tax.

Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required. Ad Process Payroll Faster Easier With ADP Payroll. There is no applicable city.

150 tax rate for nonresidents who work in San Francisco Residents of San Francisco pay a flat city income tax of 150 on earned income in addition to the California income tax and the. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation. Affordable Easy-to-Use Try Now.

Job in San Francisco - San Francisco County - CA California - USA 94199. Californias notoriously high top marginal tax rate of 133 which is the highest in the country only applies to income above 1 million for single filers and 2 million for joint filers. From imposing a single payroll tax to adding a gross receipts tax.

Businesses that pay the Administrative Office Tax will pay an additional 04 to 24 on their payroll expense in San Francisco in lieu of the additional gross receipts tax. Compute the tax by subtracting b from a and multiply the difference by 15. Save Money Make Payday a Breeze With These Top Brands - No Prior Knowledge Required.

The additional tax would either increase the Gross Receipts Tax or the Administrative Office Tax whichever applies to that business and is effective January 2022. Ad Payroll So Easy You Can Set It Up Run It Yourself. If your 2021 gross receipts were less than 2000000 you do not have to pay any estimated.

This and many other detailed reports are available with your secure login to Time2Pay. Ad Find 10 Best Payroll Services Systems 2022. Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the.

How To Avoid Paying Taxes On Your 1099 Income 6 Must Know Tricks

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Payroll Management 4 Critical Tips For Startups 2021 Abstractops

Twitter Cuts Oakland Office Space Reducing San Francisco Footprint

Taxation Of Qualified And Non Qualified Espps San Francisco Ca Comprehensive Financial Planning

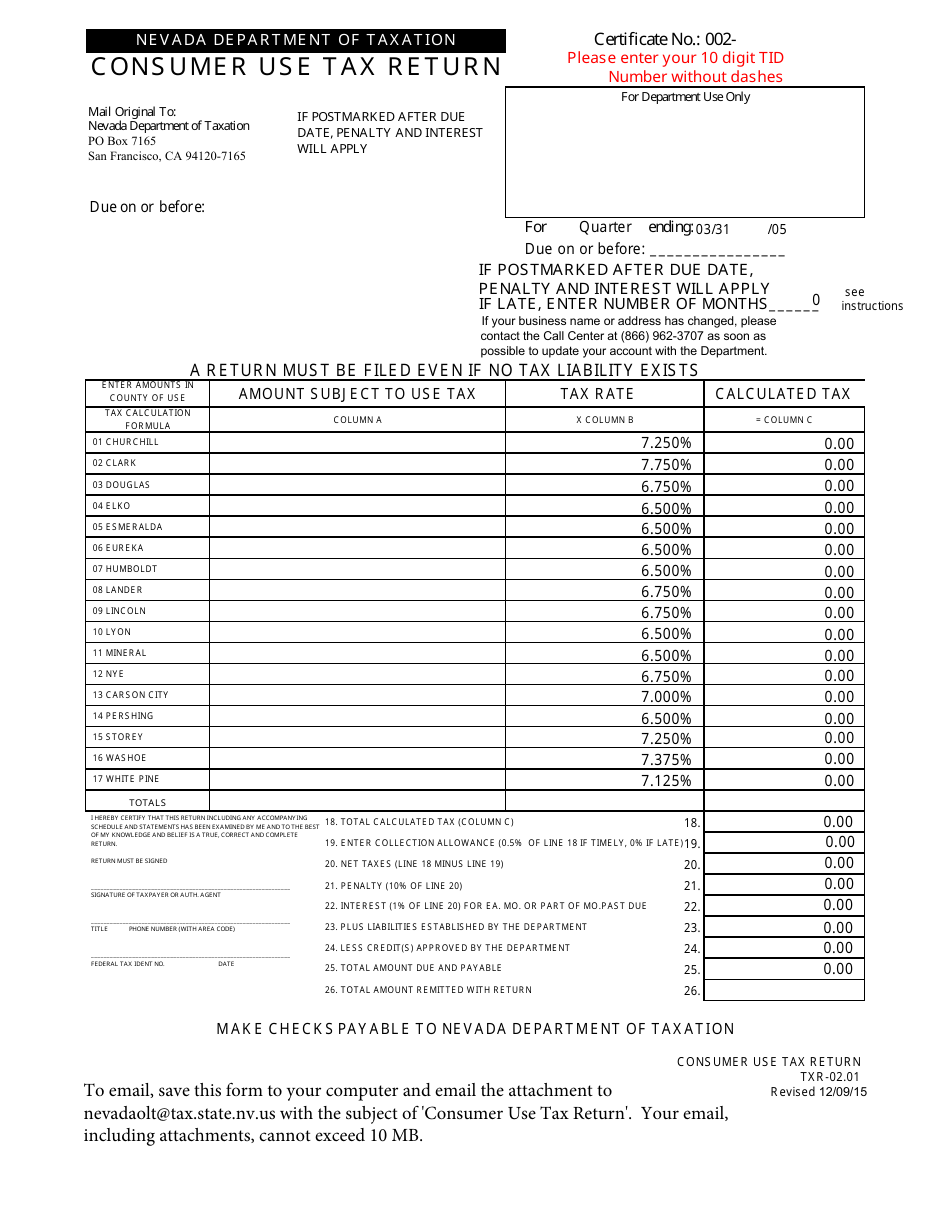

Form Txr 02 01 Download Fillable Pdf Or Fill Online Consumer Use Tax Return Nevada Templateroller

California State Taxes 2021 2022 Income And Sales Tax Rates Bankrate

States With The Lowest Property Taxes 2022 Bungalow

1099 Tax Brackets For Independent Contractors

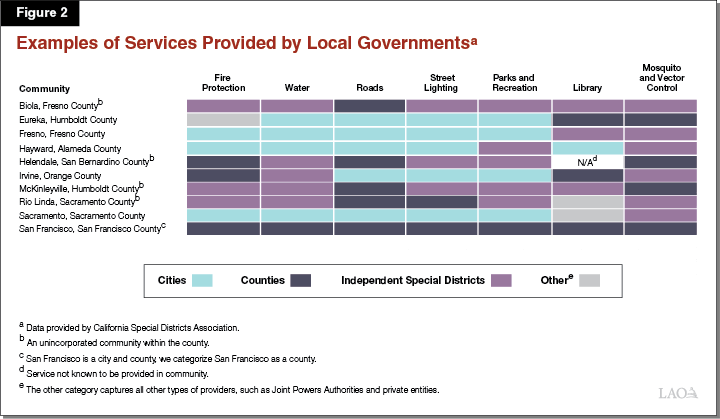

An Initial Look At Effects Of The Covid 19 Pandemic On Local Government Fiscal Condition

Portland City Imposes A New Payroll Tax Paylocity

Law Changes Make Body Shops Eligible For 2020 2021 Employee Retention Tax Credits Repairer Driven Newsrepairer Driven News

Hedge Fund Managers Tax Rates Factcheck Org

Tax Attorney And Cpa In California David W Klasing

What Is Local Income Tax Types States With Local Income Tax More

Irs Regulations Dividend Equivalent Payment Withholding Income Tax

Taxation Of Qualified And Non Qualified Espps San Francisco Ca Comprehensive Financial Planning